Increasing healthcare claim denial rates have been a persistent, industry-wide problem for years. And if you’re like the average, 1 in 10 of your claims are denied. This alarming statistic calls for a proactive approach to maintaining coding accuracy and compliance.

This is where medical coding audits come into the picture. At its core, a medical coding audit is a systematic review process designed to evaluate the accuracy and completeness of medical coding within a healthcare organization.

Conducted either internally or externally, medical coding audits serve as guardians of compliance, ensuring adherence to coding guidelines, regulatory requirements, and billing standards.

In this guide, we highlight the importance of medical coding audits, showing how they can help healthcare providers improve their revenue cycle and reduce coding errors that often lead to claim denials.

Understanding Medical Coding Audits

Medical coding audits involve a careful review of patient records in relation to the codes used for billing. The process looks for both individual errors and broader trends in coding practices. Auditors collect relevant information, such as lab reports and financial reports, to verify coding accuracy. Any discrepancies found during the auditing process may lead to necessary corrections and additional training for medical coders.

Types of Medical Coding Audits

- Internal Audits: These audits are performed by the healthcare provider’s internal audit team. While cost-effective, internal audits are often biased and limited by the auditor’s knowledge.

- External Audits: These types of audits are performed by third-party firms, like Aidéo, specializing in autonomous medical coding solutions. Such audits offer a high degree of objectivity and thoroughness because external auditors bring a wealth of experience and knowledge to the table. Moreover, these audits ensure unbiased evaluations.

- Focused Audits: These audits target specific areas or types of codes that require extra attention to ensure accuracy and compliance. Examples include high-risk procedures or codes that are prone to frequent errors.

- Prospective or Pre-bill Audits: These audits are conducted before claims submission to identify and correct errors in real-time, reducing claim denials and improving revenue cycle efficiency.

- Retrospective or Post-bill Audits: Post-bill audits take place after claims have been submitted. The main aim is to identify patterns of coding errors and areas for improvement, which is essential for long-term process improvement.

The Key Benefits of Medical Coding Audits

As a healthcare provider, you could either have an in-house coding team or opt to outsource your coding operations to a third-party provider. Either way, you must ensure regular medical coding audits to reap the following benefits:

1. Ensures Compliance with Regulations

The healthcare industry is constantly evolving, and medical coders need to stay up to date with the latest CPT codes and coding standards. Failure to comply with guidelines set by governing bodies like CMS and AMA can lead to serious repercussions such as financial penalties, legal issues, and damage to a practice’s reputation.

Routine coding audits allow for the early detection of compliance risks, enabling healthcare providers to address them proactively before they escalate.

2. Reduces Risk of Fraud

Upcoding and unbundling are two major forms of healthcare fraud. Upcoding involves submitting claims for more expensive services than those actually provided, whereas unbundling involves breaking down a single service into multiple, more expensive codes to inflate the bill.

Conducting regular audits helps identify such fraudulent practices within your coding activities so that you can take the necessary steps to address them and avoid heavy penalties.

3. Improves Billing Accuracy

Accurate medical coding is a critical component in healthcare. It not only impacts the reimbursement process but also plays a key role in overall patient care, making regular medical coding audits a necessity, not optional.

Audits help your practice identify coding errors or areas for improvement. Once you know where your practice is lacking, you can take proactive steps to enhance your documentation practices and coding efficiency.

4. Enhances Revenue Optimization

The financial sustainability of your practice is directly proportional to your revenue flow. Unfortunately, medical coding errors cost the healthcare industry approximately $36B annually in lost revenue. You don’t want to be a part of that statistic.

Medical coding audits identify errors like incorrect modifiers, missing documentation, and misapplied codes, thus letting you take preventative measures in real-time. The result? Correct claim submission in the first go, faster payments, and fewer denials.

5. Facilitates Continuous Improvement

One of the key benefits of medical coding audits is they provide actionable insights into coding patterns so that healthcare providers can pinpoint recurring issues or trends. This information can be leveraged to create a plan for training and educating your staff.

Regular audits also foster a cutting of ongoing improvement by highlighting areas that need refinement. This ensures coding practices evolve with changing guidelines and industry standards.

A Quick Glance into the Medical Coding Audit Process

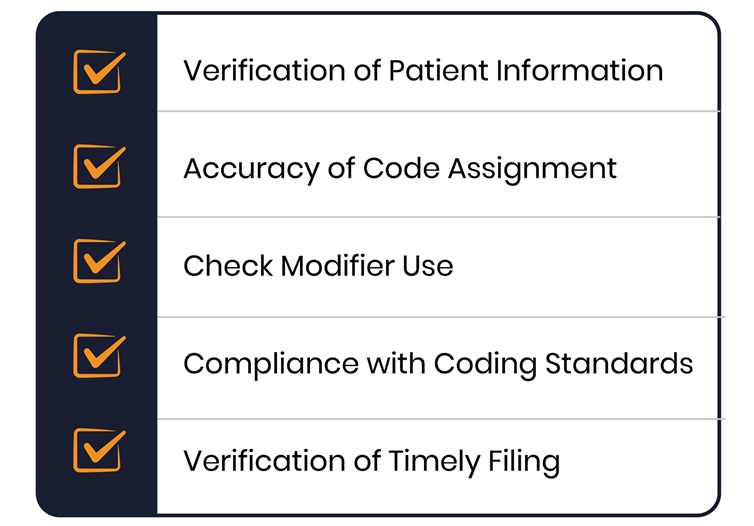

Medical Coding Audit Checklist

Here’s a detailed breakdown:

- Verification of Patient Information: Everything starts with the patient. The primary focus should be checking whether all the patient information is correct. Check their name, date of birth, insurance information, and more.

- Accuracy of Code Assignment: Another critical component of the medical coding audit checklist is reviewing whether the codes accurately describe the services rendered. Who can review this? Medical coders with the highest level of knowledge on CPT and ICD.

- Check Modifier Use: Ensure modifiers are used correctly to indicate bilateral procedures, multiple procedures, or services that differ in complexity.

- Compliance with Coding Standards: Your medical coding audits should ensure that the coding complies with regulatory guidelines by governing bodies like CMS and AMA. Also, check for compliance with Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs).

- Verification of Timely Filing: Review the date of service against the date on which the claim was submitted. Compare these dates with the payer’s timely filing requirements to ensure compliance. Once you have identified discrepancies, implement solutions like setting internal deadlines and streamlining the claims submission process.

Choose Aidéo for Your Medical Coding Audits

To sum it up, accurate medical coding plays a pivotal role in managing healthcare information and patient care quality. That’s why it is strongly encouraged to run routine medical coding audits. Without audits, you may be presented with compliance risks and lost income!

Looking for a third-party vendor to perform your audits? Look no further.

Aidéo’s intelligent coding platform, Gemini™, blends AI-driven accuracy with expert validation to deliver high-quality audit support. From detecting coding inconsistencies to improving compliance and maximizing reimbursements, Gemini™ empowers healthcare providers with the insights they need to stay ahead. With Aidéo, you are not just correcting errors—you are strengthening your entire coding process.

Click here to schedule a free demo and experience our audit process in real-time!

FAQs

Q1. How often should medical coding audits be conducted?

The U.S. Department of Health and Human Services’ Office of Inspector General (OIG) advises healthcare providers to perform annual medical coding audits to stay compliant. However, many organizations are now opting for monthly audits to maximize benefits. After all, more frequent edits = identifying more errors and streamlining the revenue cycle.

Q2. What are the common mistakes identified in coding audits?

Common mistakes identified in coding audits –

- Upcoding and unbundling

- Duplicate billing

- Incorrect or outdated codes

- Incorrect or incomplete patient information

- Misuse of modifiers

- Undercoding

Q3. How do audits affect healthcare reimbursement rates?

A common result of inaccurate coding is denied claims. Medical coding audits address this challenge head-on by pinpointing the areas of coding errors so that you can quickly resolve the issue and get adequate reimbursement for the services rendered.